Updated: August 2025 • Work in progress — we’ll add fresh data and sources as they’re published.

Every year had its “this will sink the economy” moment. Most didn’t play out, and after the hype cycle came and went, nobody mentioned it anymore.

To stop all the doom and gloom, we thought we would do a “where are they now?” article about the most hyped up economic doom and gloom “fire and downward facing red arrows and Laser Eye thumbnail photos” stories- that just didn’t.

Here’s a sober look at four widely hyped threats:

Subprime Auto, SVB/Signature Banking Collapse of 2023, China’s Evergrande, and the DeepSeek’s AI scare — and why the floor never gave way.

1) Subprime Auto Lending: The Bubble That Didn’t Burst

Narrative (2018–2021): Surging subprime auto originations would trigger 2008‑style contagion. John Oliver’s Last Week Tonight even had a full episode on this possibility in 2016.

What happened:

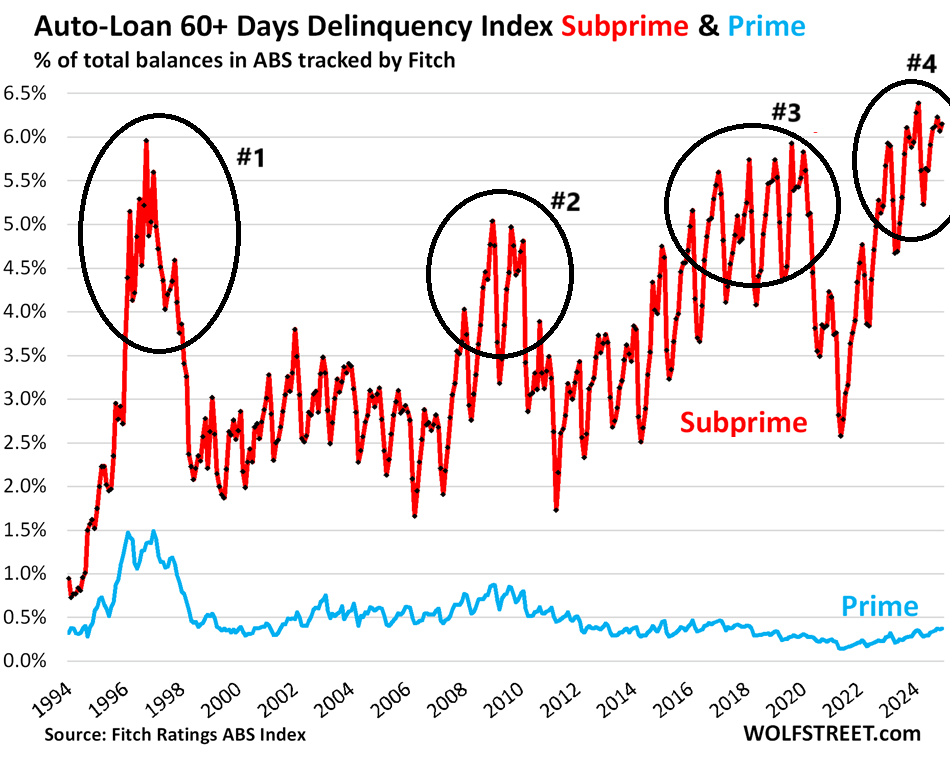

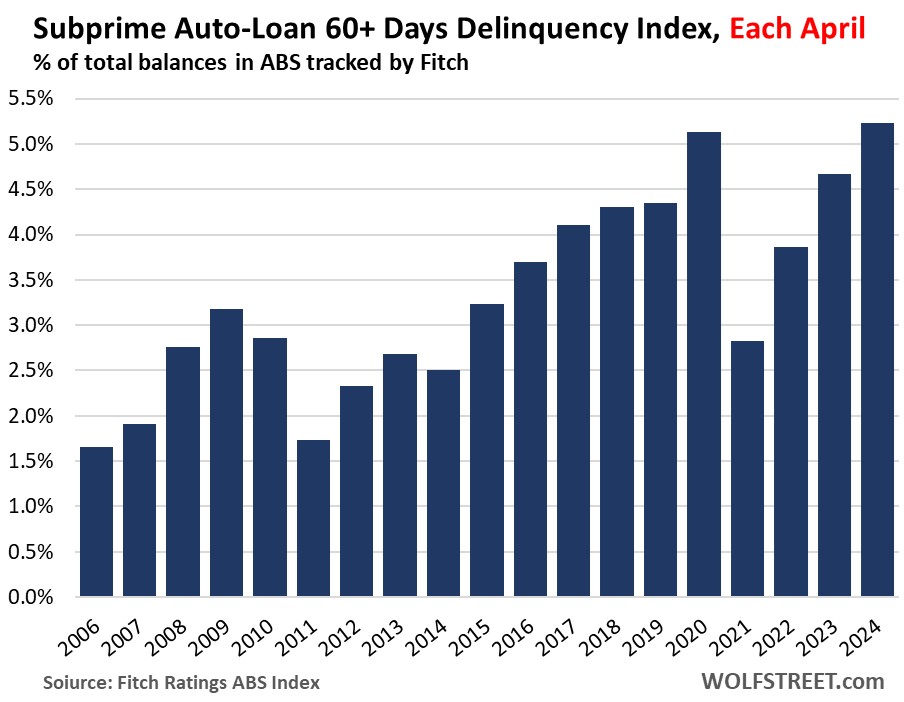

In alarming similarities to the 2008 Mortgage Apocalypse, many car lenders over-indexed into writing subprime auto loans with high yields to sell them on to investors, creating a market glut. Similar to 2008, it was thought that everyone who could possibly get into a car and afford the down payment had already done so, indicating a bubble. Many Buy-Here-Pay-Here auto lots financed everyone who came in, sometimes as high as 29% Interest. (And that doesn’t include the Insurance charge, which is more related to your credit score than your driving history these days.)

Delinquencies rose cyclically, but the market is collateralized (cars) and relatively small versus total household debt. Losses were absorbed across lenders and securitizations; spillover was limited. No systemic cascade.

- Why it fizzled: Collateralized loans, shorter duration assets, diversified holders, and better post‑GFC underwriting versus 2006–08 mortgages.

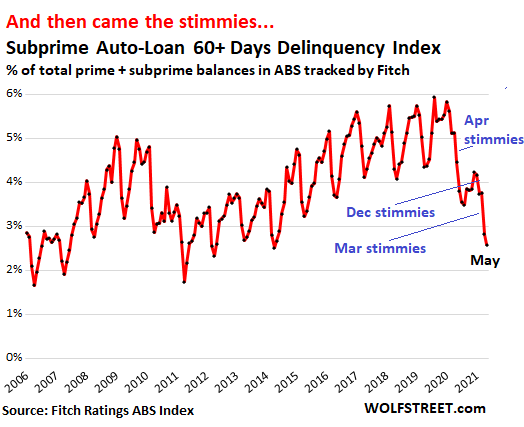

- It hardly bears repeating, but: Stimulus Payments (“Stimmies”).

At present, we are seeing used auto repossessions climb, but in all honesty, the patience we at MTT had for this to create Armageddon has come and gone.

- Watch‑items: Used‑car price normalization; unemployment spikes; lender concentration.

Sources: NY Fed Household Debt & Credit; lender 10‑Ks; industry delinquency dashboards : https://time.com/4451901/john-oliver-subprime-auto-loans/

https://www.motortrend.com/news/watch-john-oliver-perfectly-explain-predatory-auto-lending

2) 2023 Regional Bank Scare (SVB, Signature): Contained, Not Contagious

Narrative (Mar 2023): SVB/Signature collapses would spark a nationwide banking crisis.

What happened: Duration/rate risk + concentrated depositor bases led to failures. Silicon Valley Bank in particular, used by many startups to hold their war chests including Roblox, 23AndMe and many more, went bankrupt and insolvent. FDIC coverage limits of $250,000 per depositor would have let many of the depositors up a creek, until FDIC made a special exemption to cover depositors up to 100%. Signature bank also collapsed.

Authorities created backstops and facilitated resolutions.

Silicon Valley Bank, in the lead up to the collapse, had a vacant position for “Risk Manager” for at least 5 months, meaning nobody was accountable at the helm to track that they were overexposed to Treasury bonds at very low pandemic-era interest rates, whose valuations were obliterated by rising rates and inflation.

SVB did not escape allegations of being too “Woke” to handle things correctly, with the leadership concerning themselves with “Lesbian Visibility Week” and other DEI initiatives prior to the crash.

Stress hit regional bank equities, but insured deposits and liquidity facilities stabilized the system.

Earnings calls for giants like Wells Fargo, Bank of America, US Bank, and so on all came out ahead of analyst expectations resulting in large share price rallies.

No 2008‑style seizure.

- Why it fizzled: Rapid policy response; idiosyncratic balance‑sheet risk more than systemwide insolvency.

- Watch‑items: CRE exposure at certain regionals; deposit flight sensitivity to rates; unrealized AFS/HTM losses.

Sources: FDIC post‑mortems, Fed facility data, KRE index performance, bank call reports.

https://www.foxbusiness.com/economy/silicon-valley-bank-had-no-official-chief-risk-officer-ahead-collapse-but-employed-a-dei-executive

https://www.bloomberg.com/news/articles/2023-03-14/svb-s-lack-of-risk-officer-emerges-as-focus-for-fed-lawyers

https://en.wikipedia.org/wiki/Collapse_of_Silicon_Valley_Bank

3) Evergrande & China Property: Big… but Mostly Contained

Narrative (2021–2023): Evergrande’s collapse would ignite a global financial crisis.

What happened:

China is a nation where the stock market is largely closed off even to most citizens. And to those who have access to it, the reputation of the Beijing Government is definitely one of willingness to manipulate and meddle.

I remember it vividly that one day, from nowhere, China declared that standardized college admissions test, “GaoKao”, tutoring services were now completely illegal. Overnight, stocks on US markets in this space dropped 95%, plummeting to zero cash flow and bankruptcy- and the situation on shore was no different.

Due to these market instabilities, Chinese elect to invest in real estate, resulting in some of the highest valuations of home prices to incomes worldwide. Additionally, real estate construction contributed some 30% to Chinese GDP, also the highest of major economies.

Eventually, this ended up not being sustainable. Beijing’s attempts to reign in the property sector’s ballooning debt with the so called “three red lines” were crossed every time, legally prohibiting property developers from taking out more debt. Many housing projects under construction were being paid off by investors, who led payment boycotts until the projects restarted, creating cash flow problems for the developers. Without the mortgage payments on properties that did not exist, they could not keep building the property in question, leading more to boycott their payments- leading to even more stalling. A vicious cycle.

China’s property stress dragged on growth and local credit, but global spillovers were limited. Authorities ring‑fenced risk through restructuring, local policy support, and managed defaults.

Commodities and EM credit wobbled, then stabilized.

- Why it fizzled: Domestic absorption of losses; capital controls; policy intervention pacing.

- Watch‑items: Youth unemployment, LGFV debt, property completions vs. sales, household confidence.

Sources: Official Chinese statistics, IMF WEO/FSR commentary, sell‑side research timelines.

https://qz.com/2062171/by-the-digits-how-big-a-headache-is-chinas-evergrande

https://www.irreview.org/articles/the-fall-of-a-giant-how-evergrandes-liquidation-is-impacting-chinas-economy

https://qz.com/2080162/which-industries-in-china-have-the-most-corporate-debt

4) DeepSeek Shock (2025): AI Panic, Fast Reversal

Narrative (Jan–Feb 2025): China’s DeepSeek R1 model would crush incumbent AI economics; semiconductor & mega‑cap tech valuations cratered.

What happened:

The headlines came in when Chinese backed AI model DeepSeek came out and got performance metrics very similar to the flagship American models. This seemed to be impossible, as export of the state of the art AI Semiconductor chips such as NVIDIA’s series were illegal to adversarial nations, leading to the shocking revelation that either black market imports had occurred, and/or, they had managed to train a competitive model without these state of the art AI chips. Ostensibly, that they had developed their own AI chips.

Initial selloff (notably semiconductors) gave way to reassessment; analysts called panic overdone, business models intact, and competitive dynamics more nuanced. Markets retraced much of the knee‑jerk move.

- Why it fizzled: Moats in distribution, data centers, software stacks; monetization resilience.

- Watch‑items: Unit economics of inference vs. training; open‑model diffusion; China export controls.

Sources: Broker notes (UBS/Bernstein), market price data around announcement window.

https://www.reuters.com/world/china/deepseek-aids-chinas-military-evaded-export-controls-us-official-says-2025-06-23/

https://www.thesun.co.uk/tech/33060483/china-ai-deepseek-trump-market-collapse-west/

https://www.sydney.edu.au/news-opinion/news/2025/01/29/deepseek-ai-china-us-tech.html

Other Frequently Forecast Doom‑Loops (That Didn’t Break the Economy)

- Debt‑ceiling brinkmanship (2021–2024): Recurring standoffs; no technical default is theoretically possible.

- Crypto collapses (2022–2023): Severe sector drawdowns; limited macro spillover.

- Energy price spikes (2022): Inflationary shock; no global depression.

- IPO/VC “winter” (2022–2024): Funding reset; broader economy adapted.

Help us expand this list in the comments below: what did the headlines say would “end it all” that ultimately didn’t?

Why This Matters

We are not strangers to the news cycles that have happened. At Master Trade Tools we’re digital natives, we were software engineers and AI programmers before we brought democratized technical-analysis trading to the masses.

We want to give you actionable trades, without falling prey to the 15 minutes of fame that every new economic crisis generates.

Why We Track This at Master Trade Tools

We build tools that keep you grounded: evidence first, drama last. Our dashboards highlight probability, not panic — so you can allocate with a cool head when the news cycle heats up.